Table of Content

- Auto-Owners Home Insurance Review 2022

- What to expect with Auto-Owners home insurance

- What additional benefits does State Auto Home Insurance offer?

- Table of Contents

- Most Recent Customer Review

- How much does Auto-Owners home insurance cost?

- *16-year-old rates reflect the total cost of parents insuring a teen on their full coverage car insurance policy.

While many homeowners get excited at the thought of making some extra money by listing their home or a room on a home-sharing network, most don't stop to consider if they're properly insured to do so. Our Home-Sharing Activities endorsement provides coverage for furnishings, theft, liability and medical expenses, and much more. A Dwelling Fire policy allows customers to select the coverage they need – they can buy liability coverage on a Dwelling Fire, or they can insure just the building and no contents. Auto-Owners sells different types of home-related insurance coverage including home, condo, renters, rental dwelling and mobile home.

This insurance protects the items in your home, like your furniture. If they're damaged or lost, personal property coverage could help you cover the cost of replacing them. It can help cover the necessary medical expenses in an accident, regardless of who's at fault.

Auto-Owners Home Insurance Review 2022

Plus, you can choose from a whopping 15+ other policy add-ons to ensure your home and belongings are fully protected. The Protection Plus package comes with lock replacement, $1,000 in coverage for freezer contents lost due to power outage or breakdown and coverage for golf cart rentals. Homeowners can also add the HomeXtended endorsement, which offers more financial protection for your home and personal belongings. Otherwise, whether State Auto is the best option for your home insurance needs will vary based on your priorities, where you live, and the coverages you’re looking for.

This protects you against bodily injury and property damage for which you or the residents of your home are responsible. This covers structures on the residence premises separated from the dwelling by a clear space or connected to the dwelling by a fence, utility line, or related connection. Examples include a detached garage, tool shed, driveway, swimming pool, gazebo, or fence. As a matter of policy, BBB does not endorse any product, service or business. BBB Business Profiles generally cover a three-year reporting period.

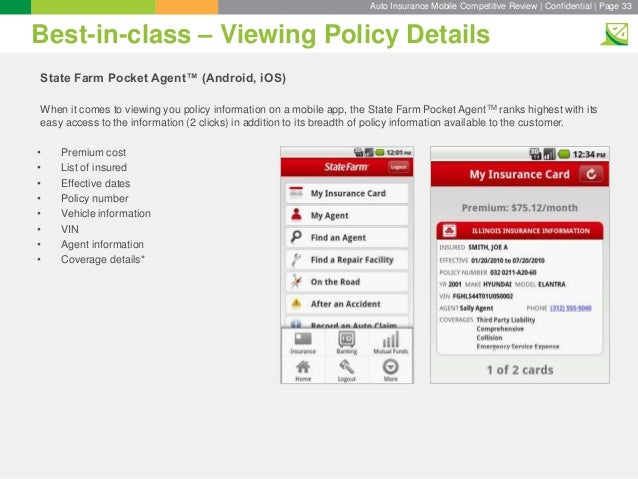

What to expect with Auto-Owners home insurance

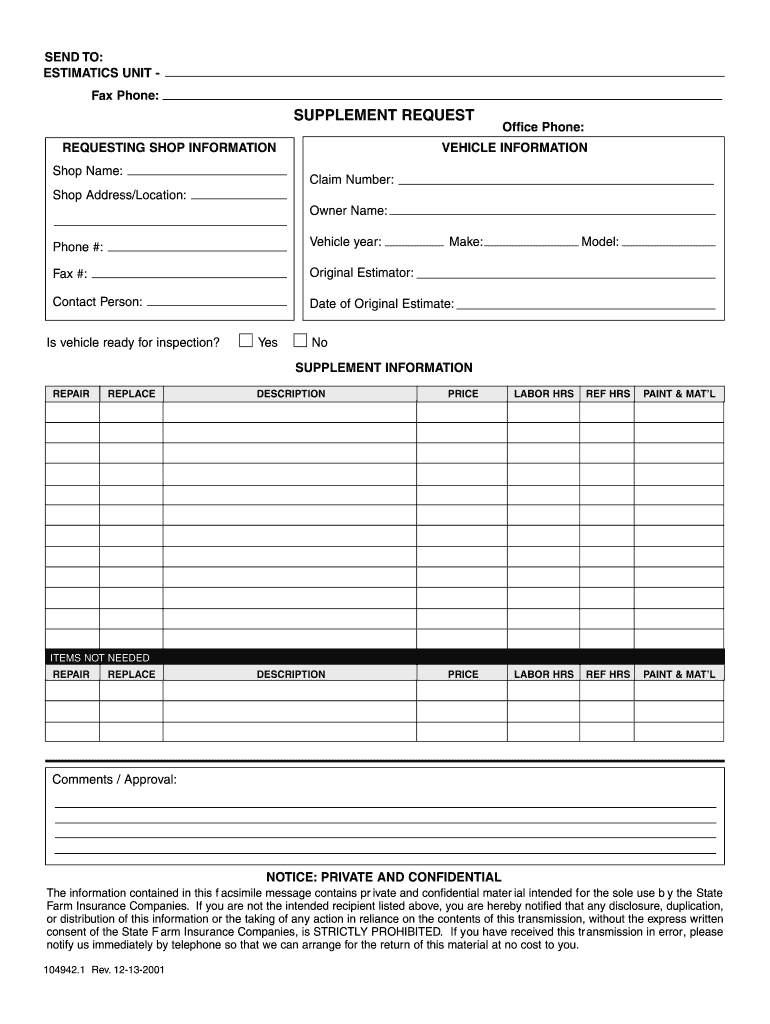

With State Auto, you can file a claim on the website or call the claims number to talk with your personal agent. Make sure you have your policy information and details about your accident handy when you call. This rider protects homeowners in the event of identity fraud and pays for the cost of restoring their identity. State Auto Home Insurance is an insurance carrier based in Columbus, OH. The company was founded in 1921 and offers home insurance in 50 states . See if you qualify for student loan refinancing and compare real time offers. State Auto is a competitive carrier on price and can often be the best-priced offering with well-rounded coverages.

She aims to make the insurance journey as convenient as possible by keeping the reader at the forefront of her mind in her work. Before joining the team, she worked for nearly three years as a licensed producer writing auto, property, umbrella and earthquake policies. We are an independent, advertising-supported comparison service. Optional coverage that provides “open perils” coverage for physical loss or damage to specifically described items, with a few exceptions.

What additional benefits does State Auto Home Insurance offer?

Forbes Advisor adheres to strict editorial integrity standards. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners. Founded in 1916, Auto-Owners Insurance provides insurance to almost 3 million policy members. Headquartered in Lansing, Michigan, Auto-Owners is the 12th largest home insurance company in the nation. You may be able to buy an insurance policy from State Auto, but it will eventually be converted to Liberty Mutual.

This ratio means that State Auto receives more complaints than most other insurance companies in the nation. SuperMoney.com is an independent, advertising-supported service. The owner of this website may be compensated in exchange for featured placement of certain sponsored products and services, or your clicking on links posted on this website. This compensation may impact how and where products appear on this site . SuperMoney strives to provide a wide array of offers for our users, but our offers do not represent all financial services companies or products.

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site.

Since our founding in 1921, doing the right thing has been at the heart of who we are as a company. We did the right thing by being among the first in our industry to address profitability issues in homeowners insurance. We did the right thing by taking important but difficult steps in 2011 and 2012 to improve our capital position and sustain our financial stability. And we did the right thing by addressing the issues with RED head-on. Our self-guided property inspection process will make sure we’re providing you with the most accurate coverage and help give you peace of mind.

Property Damage Liability, including tangible damage to property, including loss of use. Here are some simple ways to save big on your personal home insurance. Extra protection for your home and possessions (automatically included in Premier and can be purchased with Protection Plus policies; not available for Standard). If you are a new customer and you request a policy quote before the policy’s start date, you can get a discount. If you don’t have a history of home insurance claims, you may be eligible for a discount. Water backup of sewers or drains pays for damages to your home if they are damaged due to a water backup.

Performance information may have changed since the time of publication. You may wish to purchase umbrella insurance from Auto-Owners that will give you liability protection beyond the limits of a home insurance policy. Dwelling coverage pays to repair or replace your home and attached structures due to problems covered by your policy . We pulled quotes across the state of Illinois for an 18-year-old male driver, a 25-year-old male driver and a 30-year-old male driver.

No comments:

Post a Comment